Today I am going to tell you 3 stories. Out of which 2, I heard from my IIIT professor and 1, I read in a biography book.

So here they goes:

Story 1:

A Bengali bride got married and the couple started a new journey, in a new house, in a new city. She is very good at cooking Fish (and most importantly she enjoyed it).

Fish is more or less on the menu on every alternate day. The process she normally followed is “She used to chop 2 inches each on both ends of the fish”, and put it in the micro oven. Everything was going good, until the day has come when the husband observed this peculiar behaviour and asked “WHY?”

Not knowing the answer, her reply was “My mother used to do so”.

Curious hubby, called up his mother-in-law to ask the reason. But all he got was the same answer “My mother used to do so” !

Not being satisfied with the answers, he tried to contact the old lady (mother-in-law’s mother), and asked “Why did you teach your kids to chop 2 inches on both the ends of the fist while cooking in micro oven ?”

The old lady was astonished with this question and replied, “What, Are they still following it ?”

Her explanation:

There used to be no micro oven nor gas stoves in those days, and hence I had to fry the fish on pans placed on wooden fire (Primitive Cooking). The length of the pan was small and hence I had to cut 2 inches each and fry it, so that it will be evenly cooked. “But I never knew that they are still following that practise even after having micro ovens, gas stoves, and large pans”.

Story 2:

There used to be an Indian Saint who lived in the banks of Ganges river along with his disciples. The ashram was so calm & pleasant. Everything was going good, until one day a cat from some where entered the ashram and started making noise, disturbing the saint and his meditation. It also used to poop all round the ashram making it even more disgusting for the disciples to make it clean.

Frustrated with these actions, the saint ordered the disciples to “Tie the cat and put it in a basket during his meditation hours”, so that it will not disturb him during his most productive time.

Everyday just before his meditation starts, he used to asks his disciples one single question, “Had the cat tied in the basket ?”. If the answer was Yes, he used to continue with his meditation, or else it was not so good day for disciples from the saint. This continued for years together and it became a daily routine & habit of the disciples to make sure the cat is tied before saint’s meditation begins.

But one fine day, the Cat died. This made the disciples furious. Being afraid of his saint, “who needs the Cat to be tied and kept in the basket”, everyday just before his meditation, all the disciples went in search of a NEW cat, bought it, tied it & kept in the basket before his saint ask for it.

(True) Story 3:

Warren in his 19, was asked by one of the then greatest traders of Wall street “Why he wants to buy GIECO ?”.

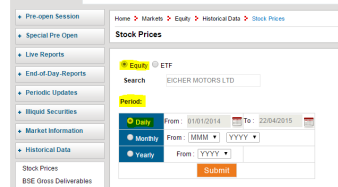

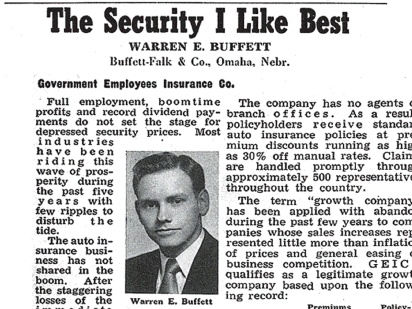

(This is image of the article which Warren wrote on GIECO during his initial days)

Warren knowing in & out of the entire company, his future potential, the scope, low cost provider which is a moat etc, kept everything in his mind and answered just one line,

“Because Graham likes it”. Of course Warren never forgot the expression given by the trader at that time.

This takes us the topic of the post “Socratic Questioning”.

Definition: Socratic questioning is disciplined questioning that can be used to pursue thought in many directions and for many purposes, including to explore complex ideas,

to get to the truth of things, to open up issues and problems, to uncover assumptions, to analyze concepts, to distinguish what we know from what we don’t know, to follow out

logical implications of thought or to control the discussion.

The key to distinguishing Socratic questioning from questioning per se is that Socratic questioning is systematic, disciplined, deep and usually focuses on fundamental concepts, principles, theories, issues or problems.

Watch this 2 min video:

Socrates was a deep thinker. He always believed that great ideas needs time & effort. If you get a great idea without critical thinking (which he states in 6 different points which we are going to discuss below),

more often than not, its not a great idea or not going to be one for long time.

So what did he say ?

1) Revealing the issue: ‘What evidence supports this idea? And what evidence is against its being true?’

Socrates asks us to search for dis-confirming evidences.

Wait a minute ? Are you thinking, what I am thinking right now ?

Yeah, you read or heard that many times. Where ? Well, our 2 Charles had spent there entire life practising this particular thought.

Charles Darwin & Charles T Munger.

They always ask us to look for dis-confirming evidence. If a particular company is destined to give good returns, spend some time negating the thought, push the thoughts to get the evidence (if any) to prove that “It will NOT give good returns this year” (Inversion).

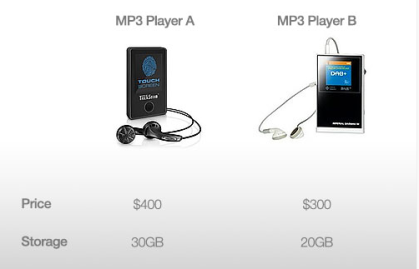

2) Conceiving reasonable alternatives: ‘What might be another explanation or viewpoint of the situation? Why else did it happen?’

Sanjay Bakshi sir in his recent podcast with Shane Parrish of Farnam street says, he always articulate a problem by saying “The Part of the reason is…”,

meaning there are many reasons for a particular thing to happen. If we try to fix ourself with the first or second reason we think of, it is like pondering ourself to first confirmation bias and shutting off our brain to think further. In many cases is not recommeneded by these people.

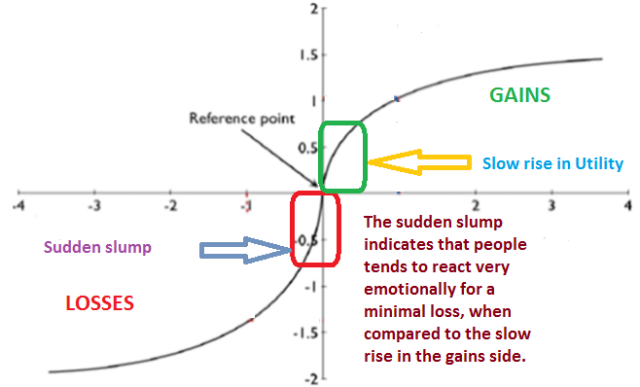

3) Examining various potential consequences: ‘What are worst, best, bearable and most realistic outcomes?’

Richard Branson’s autobiography “Loosing My Virginity”, was an amazing, inspiring & roller coaster ride. In the book he says, his idea to start Virgin Airlines had became strong

only after he calculated the downside (roughly). He says, if Airlines fails all it takes is 2 quarter earnings of most successful “Virgin Records” and one year of effort.

He always insist to keep an eye on downside. Even while opening his 301th business also, he made sure that if it fails, it should not have more impact on other 300 businesses.

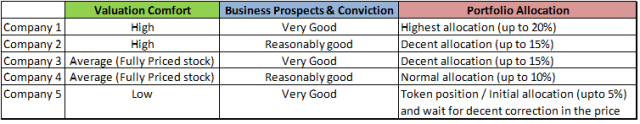

Isn’t this how we should learn about Portfolio Construction and practise it ?

4) Evaluate those consequences: ‘What’s the effect of thinking or believing this? What could be the effect of thinking differently and no longer holding onto this belief?’

The best thing to do is to disprove thyself. Once you found few points which contradict your initial thought process, feel happy to accept them & continue this process.

5) Distancing: ‘Imagine a specific friend/family member in the same situation or if they viewed the situation this way, what would I tell them?’

Guy pier says, he practise a strong thought process where he places himself in the shoes of Warren & Charlie in every part of his daily life. He just imagines how they both will do that thing which I am going to do now. There is no need to restrict this thought process to Investing. Infact Warren & Charlie are great investors because there were rational human beings & NOT vice versa.

Finally,

Asking these 5 Why’s, will bring us to the root cause of any problem.

Let’s try to make “Socratic Questoning” a part of our daily life & Investing practise.

Happy Learning & Investing 🙂

-END-