In our recent AIFW Investors meet happened in Bangalore on 14th Dec 2014, one friend asked me why do we look at PBV ratio for banks much before any other ratio ? Hence I thought of writing a post explaining the reason behind that valuation metric.

Yes, that’s true that Equity analyists while analysing bank stocks emphasize their valuation more on PBV (Price to Book value). Reason ?

Before answering it. Firstly, lets try to understand what is unique about Financial service firms ?

Financial service firms have much in common with non-financial service firms. They also try to be as profitable as they can, they also worry about competition and want to grow rapidly over time. They are also judged by the total return they make for their stockholders. But the main problem comes in this aspect.

Is DEBT a Raw material or Source of Capital for the banks ?

Any company can raise the capital by using 2 ways, Debt (bond holders) and Equity (shareholders).

When we value the firm, we value the value of the assets owned by the firm, rather than just the value of its equity. But when coming to a Financial Firm, debt seems to considered as a different aspect. “Rather than view debt as a source of capital, most financial service firms seem to view it as a raw material.”

In other words, debt is to a bank what steel is to Tata Motors (a Raw material). Treat is as a raw material that something to be molded into other products which can then be sold at a higher price and yield a profit.

For example, should deposits made by customers into their checking accounts at a bank be treated as debt by that bank? Especially on interest-bearing checking accounts, there is little distinction between deposits and debt issued by the bank. If we do categorize this as debt, the operating income for a bank should be measured prior to interest paid, which would be problematic since interest expenses are usually the biggest single expense item for a bank.

Usually, P/BV figures for companies in the services industries like software and FMCG are high as

compared to those of companies in the sectors like auto, engineering, steel and banking. This is due to sectors such as software and FMCG have low amount of tangible assets (fixed assets etc.) on their books and therefore, the P/BV may not be a correct indicator of valuation.

On the other hand, capital intensive businesses such as auto and engineering require large balance sheets, i.e., they have a large amount of fixed assets and investments. P/BV is a good indicator of measuring value of stocks from such capital intensive sectors.

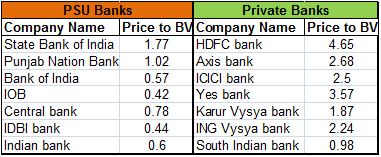

If a company is trading at a P/BV of less than 1, this indicates that the company is earning a poor return on its assets (ROA). NPA’s are the major concern for all the PSU banks becuase of the same reason, all these banks trade at PBV ratio less than 1.

The below image compares the PSU banks (high NPA’s) w.r.t to Private banks (Low NPA’s) and their relative PBV valuations.

What does P/BV fail to indicate?

P/BV indicates the inherent value of a company and is a measure of the price that investors are ready to pay for a ‘nil’ growth of the company. As such, since companies in the services sectors like software and FMCG have a high growth component attached to them, Price to Earnings ratio (P/E Ratio) would be a better method of gauging valuations.

The ratio has its shortcomings that investors need to recognise. However, it offers an easy-to-use tool for identifying clearly under or overvalued companies.

-END-