How did it all started in India and reached beyond Dalal Street ??

In this post let’s try to see how Equities have evolved in India and reached retail investors.

Even though Stock exchanges were in place from more than 4 centuries (Amsterdam Stock Exchange being the old stock exchange founded in 1602),

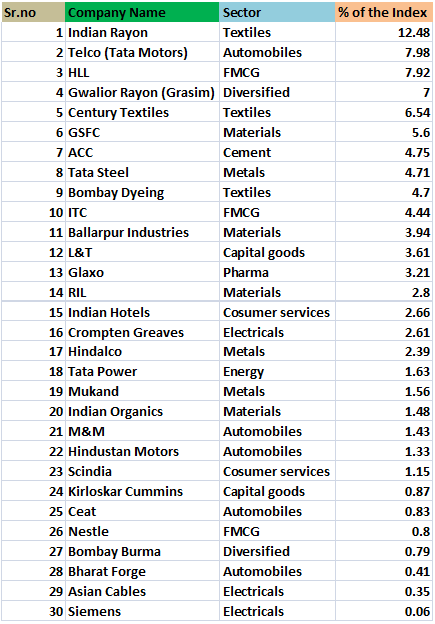

In India stock operations have started in the mid of 18th century. It was actually during the mid of 1970 that BSE had started its Index (Sensex with base value of 100 consists of 30 stocks) when it all started.

The late 1970s witnessed the start if the equity cult in the Indian stock markets. During those times, textile was a hot sector and the industry ad a weightage of over 20% in the BSE Sensex.

Reliance Industries entered the capital market in the late 1970s and with its state of art ultra modern facilities was about to change the rules of the game. And it did so. The public issue came with such fan fare. The company had a spectacular rise with a huge following the retail investors. Mr. Dhirubhai Ambani used to conduct his AGM meetings in cricket grounds.

Please watch this below video clip of movie “Guru” to understand it.

He was the man who set the equity cult in India by being very investor friendly and handsomely rewarding his shareholders.

During those days the Foreign Exchange Regulation was enacted and all foreign companies were asked to either list their

shares on Indian bourses or quit India. Some companies like Hindustan Lever (HLL), Nestle, Colgate obliged but others like Coca Cola quit.

This was the begining of a new era in Equity investing and all these companies that got listed are called asked

“FERA” (Foreign Exchange Regulation Act) companies. They soon became the stock market favourites and almost all of them

commanded a high PE valuations. Indians for the first time got an opportunity to invest in foreign owned companies.

The then Big Daddy “Controller of Capital Issues” controlled the pricing of IPO from Indian shareholders getting them at ridiculous valuations (which was not the case these days)

For example, HLL was “FORCED” to offer its price at Rs.16 (FV of 10 at a premium of 6). These kind of companies made a lot of wealth

for the Indian shareholders. Infact Ace and old value investor Mr. Chandrakanth Sampath made all this fortune from consumer goods.

Read more about him here.

With the success of these IPO’s we have seen many international companies entering into Indian capital markets.

Investing was once meant for few business houses or few individuals, slowly at that time it moved towards retial investors.

Many companies like Xerox, Tektroniz, Wartsila, ZF steeting, Gillete etc entered Indian markets.

Foreign companies like engineering gaint Siemens and pharmaceutical innovator Glaxo was listed and were able to get ideas and technology from their parents. They were considered as Future growth stories. Glaxo commanded 3.21% weightage in index and HLL at 7.92%.

The First Index composition of India !!!

Industrial icons of India “Tata” & Birla groups have immense respect among investors which also translated into their companies weightage in the index. In the later post, we will discuss how these companies performed in Long run, if we have bought them “just because those were Index Stocks”. Till then, Happy learning and Investing 🙂

Sources & References

Stocks to Riches by Parag Parikh

Motila Oswal wealth reports

Nice Krishna.

LikeLike

Thanks dear Shaji !!

LikeLike

One more good article as usual. Keep going krishna 🙂

LikeLiked by 1 person

Can all changed index stocks list in different times be made available….

LikeLike

Dear DD,

Yes we can get it. I some how can’t able to paste the data in comment section. Hence mailed you the composition of BSE Sensex at different time points to your mail id.

Please check.

Best Regards

Krishna Kishore A

LikeLike