I first got stumbled upon the term “Prospect Theory” few years back in Daniel Kahneman’s wonderful piece of art, Thinking Fast and Slow.

It was in 1979 when Daniel Kahneman along with his colleague, the late psychologist Amos Tversky delivered a paper in Econometrica by the name “Prospect Theory: An Analysis of Decision under Risk” (here is the link for the original paper), came up with the concept of Prospect Theory also called as “Loss-aversion theory”.

Definition:

Prospect theory says that, people value gains and losses differently and, as such, will base decisions on perceived gains rather than perceived losses. Thus, if a person were given two equal choices, one expressed in terms of possible gains and the other in possible losses, people would choose the former.

For example, what do you prefer ?

1) Toss a coin. Heads, you win $100 and if it is tails, you win nothing (in other words, “you loose nothing”. Framing of words do matter).

2) Get a $46 for sure.

Here, I am not trying to figure out the most rational or advantageous choice, but just to find the intuitive choice.

Please watch this video:

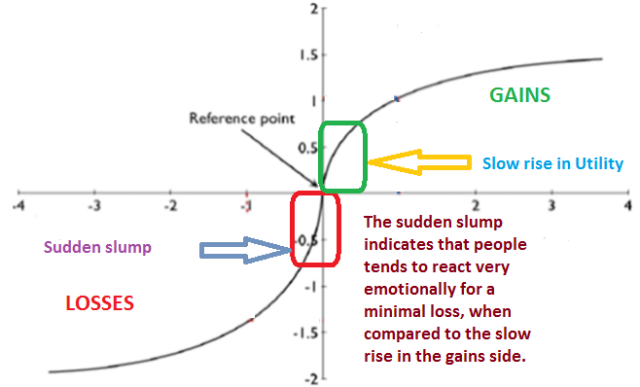

Following graph explains the Prospect Theory and lets try to understand the graph in detail:

Reference Point: From what point, do I estimate gains and losses ? It is physiological and is subjective to manipulation. It is not necessary to be a Zero in value (Premiums paid in Option pricing is a perfect example of reference points)

BTW, the entire Insurance Industry works on the emotional & financial aspects dealing with the small red box in the above graph.

Prospect Theory also talks about “Decision Weights” which says:

“Prospect theory also differs from traditional economics in the way it handles the probabilities attached to particular outcomes. Classical utility theory assumes that decision makers value a 50% chance of winning as exactly that: a 50% chance of winning. In contrast, prospect theory treats preferences as a function of “decision weights” which do not always correspond to probabilities.”

It actually postulates that human beings tend to overweight small probabilities and under react to moderate and high probabilities.

For all investors, following aspects will be considered consciously or subconsciously during their portfolio selection and weightage allocation.

a) The risks and uncertainties of the company.

b) When investors are “motivated” to see things positively about the company (WYSIATI principle: What You See Is All That Is)

c) Analysing the short-term vs long-term story of the companies and many more…

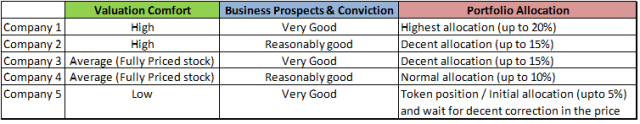

Now coming to the portfolio allocation part of it, many people knowingly or unknowingly will follow the Prospect theory in practise while building there portfolios in risk mitigation methods. Meaning, they are applying Decision Weights proposed by Kahneman.

How ? Lets see my own Portfolio strategy which I follow (or at least try to follow) most of the times:

As many of you, I was also immensely benefited from Value Pickr forum and above strategy is just one of many things I learnt from the collective learning that happened in that amazing website.

So if you observe, What was I doing ?

I was estimating different weightages and using them to evaluate a range of probable gains.

I was unknowingly applying “Decision Weights” much before even I know the concept of Prospect Theory (this concept happened to me at much later stage of my investment journey).

I may be wrong in the strategy which I am currently following, but what ever the new strategy I pick tomorrow, it will for sure follow the concept of Prospect Theory.

Strategies Change, Theories Evolve !!!

Happy Learning & Happy Investing 🙂

-END-

Thats a nice and simple way of saying high conviction and low conviction portfolio components are also a bit emotional in nature than being totally rational. And that risk averseness is a form of investment thesis

LikeLike

Thanks Aravind.

Yes, the Prospect theory works subconsciously (some times even unknowingly) when we are to deal with High conviction stocks & allocating certain % of portfolio to them.

LikeLike