I am posting this after a long time and my apologizes for that. Before starting anything, my sincere thanks to Pattu sir, Ashal Jauhari ji and to AIFW for constant encouragement and support.

Now lets see what we are going to discuss today:

The more I try to understand Nassim Taleb, the more I mould myself to see this world in a probabilistic view.

Do you think assigning probability to real time world helps ? I am not sure, I am still exploring myself.

BTW, if there is one person whom I consider as the father of probability after Blaise Pascal, Girolamo Cardano is Taleb himself.

See how he describes himself in his Twitter account:

Today, lets try to understand 2 examples (a combination of Game Theory & Probability) and how it helps us to view our investments in that direction.

(I pick this examples from various book and the source is mentioned below in Reference section. I highly recommend you to read those books)

Example 1:

How many times have you heard these comments from people ?

1) I bought Lovable Lingerie / Maxwell industries thinking this will be the next Page Industries ?

2) I bought Mastek and Mphasis as they can be the future Infosys ?

3) Granules India is the next Aurobindo pharma and I bought it.

But, do we have a reason behind these decisions, rationally or psychologically ? Yes !!!

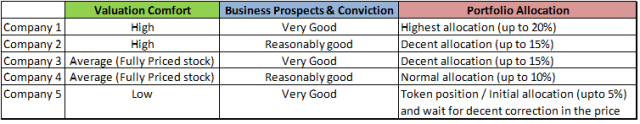

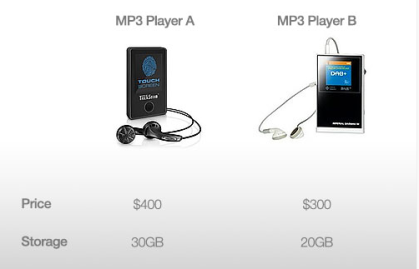

I want all of you on a Game, Choose the best option between these 2 ?

Some may prefer A for its greater storage while other may prefer B for its lower price.

Now let’s add a new MP3 player to our pricing table. MP3 Player C is more expensive than both A and B and has more storage than B but less than A.

The addition of “Option C”, which consumers would presumably avoid, given that a lower price can be paid for a model with more storage, selects A, the dominating option, to be chosen more often than if there are only two choices in Consideration.

Because A is better than C in both respects, while B is only partially better than C.

Why this has happened ? The answer lies in what we call “Decoy effect”.

Decoy Effect: The decoy effect (or asymmetric dominance effect) is the phenomenon whereby consumers will tend to have a specific change in preference between two options when also presented with a third option that is asymmetrically dominated.

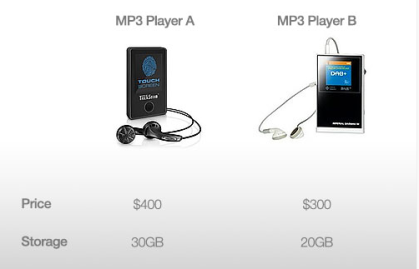

For investors who had missed the ride of Page industries, they try to think to find an “alternate” that will give them the same kind of returns.

And this is how the process starts in general. Comparing Page Industries with one of its compitetors.

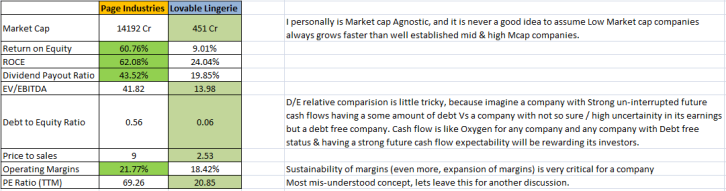

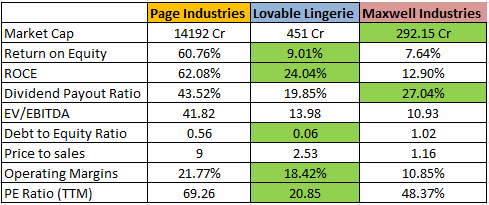

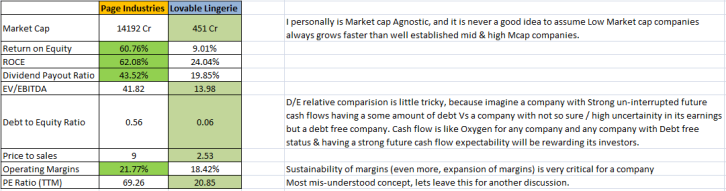

Here I am comparing Page with Lovable Lingerie

So people who missed Page industries in their search for “Similar”, found the Lovable. But still are not sure whether to proceed further of not ?

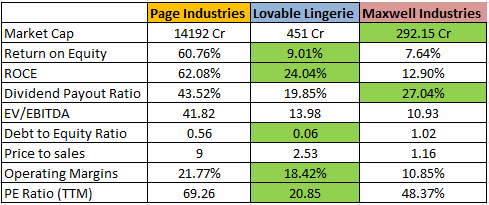

Now comes another option, (Option C into picture), Maxwell Industries and compare Lovable vs Maxwell.

We can see that Lovable looks comparatively better than Maxwell and their are high chances we end up buying Lovable.

What had just happened ?

We started our search to find “Next Page Industries” BECAUSE it is highly valued by the market.

Remember Peter Lynch rule ?, “Always the Next of something, fails more often”

We convinced our-self saying, “since the First player in the sector did well and Third player is not doing well, Second player may do well”.

The probability of Second player amazingly increased, when third player comes into picture.

It is this thought process that will push us to buy the non performing companies and get stuck with them in our portfolios. So next time if someone says, I bought this because it is going to Next of that!, in your mind, remember it is called “Decoy Effect” 🙂

Example 2:

Understanding the importance of Conditional probability in real life: Consider this,

Suppose there are three cards. One card is red on both sides (call it RR), one is white on both sides (call it WW), and one has a side of each color (call it RW or WR).

One card is chosen at random (i.e. blindly out of a bag) and put it on table. You are able to see that one side of the card is red. What is the probability that the other side of the card is also red?

Answer is simple right, 0.5 !!!

Because, the card is definetly not WW, so it is either RR or RW. Since it was drawn randomly, these cards are equi-probable and hence 0.5.

Is it ? Think again !!!

Clearly all red (RR) is twice likely to show a red face up as a card that only has one red side. Hence, the actual probability is 2/3 🙂

Moving on… Recently I was looking into a Pharma company (no names taken please and yes trying to understand Pharma as I realized how much I missed ignoring this wealth creating sector), and had seen the Conditional probability scenario in its business.

They are having the highest API (Active Pharmaceutical Ingredients) installed capacity in the world. Also they are into PFI (Pharmaceutical Formulation Intermediates) and FD (Finished dosages) as well.

API is the low margin product (high single digit to low double digit).

PFI magins are little higher compared to API’s but less than FD’s (somewhere b/w 15%-20%, based on the scale & operating costs).

Finished Dosages is the sweet spot of this Pharma company with margins above 20%.

Good thing is this company is trying to move above the value chain, it started purely as a API player now ventured into FD space.

But here is the catch,

API capacity is fully utilized. PFI capacity is 70% utilized and Finished Dosages is 50% utilized.

According to the recent con call, the management said, in order to increase the production of FD’s (to its full capacity, also remember this is the sweet spot of the company with highest margins), they have to increase PFI capacity, which will only happen after increasing API capacity (low margin product).

In other words, untill you spend your money (at a greater speed) on low margin products, you can’t get the fruits of high margin products (at a later period of time and mainly at a slow pace)

Now lets take the numbers:

Assume, the probability of this company utilizing the new capacity of API to the fullest : 90% (as already said, since this company is a leader in API, this will not be a problem)

Now the probability of utilizing the new capacity of PFI to the fullest : 80%

And probability of utilizing the existing capacity of Finished Dosages to the fullest: 60% (please note: this company now itself is highly under utilizing FD capactity with only 50%)

Now, since these events are dependent on each other and happens only on particular “Conditions” executed in a particular order (API->PFI->FD),

Probability of Finished Dosages product having complete utilization is = 0.9 * 0.8 * 0.6 = 0.43%

This dramatically decreases the probability of final outcome which we are looking for 😦

So these are the two examples for this post. Some may say that these are quite commonsensical in nature. Yes, I do agree. Also, every common sense / rational approach will have a behavioral and psychological theory associated with it.

If we can try to understand the meaning of our actions like what is driving us to do that & the theory behind it (instead of just focusing on the mere outcomes), our life looks much more interesting. I assure you that !!!

Happy Investing & more importantly, Happy Learning 🙂

-END-

References & Recommendations:

Thinking fast & Slow by Daniel Kahneman

Predictably Irrational by Dan Ariely

Cognitive Psychology: Mind and Brain by Smith Edward

Fooled by randomness by Nassim Taleb