Please NOTE: This post is not to discuss”How to create Multibaggers ?”, but to understand how does it happen and how does it unfolds during that time.

Most of the investors who come to stock market have one thing in common. They dream to have a few multibaggers in his/her portfolio. Nothing wrong in that, but the problem comes if he doesn’t know how it works.

The curiosity to understand how few things teaches a lot. And that undying quality of the investor is his strength.

Now lets try to unfold how multi-folds happen.

Their are mainly two types of multibaggers that happen:

1) Steady compounding machines: These companies usually are sector leaders and are compounding machines (read my previous article here). They compound for decades together (due to their inbuilt Longevity nature) and create HUGE wealth for share holders.

Few Examples:

HDFC Bank: It had its IPO in March 1995 and till date it has multiplied 1000 times. If you have few hundred shares of HDFC Bank during its IPO, you will be sitting next to Sanjoy Bhattacharya and Raamdev Agrawal during the investors meets.

Asian Paints: This company came public in 1982 and have give around 2400 times till date (adjusted for splits & bonuses).

ITC: In 1988, the total market cap of the entire company is just 110 crores (meaning, with just 1.1 crore you can buy 1% of this debt free company). Now, the total market cap of the company is 2 Lacs 92 thousand crores (Just imagine about those 1% if you have own, now turned to 2920 crores excluding dividends).

The list never ends.

2) The Newbies, fast runners and turnarounds:

This is the interesting part of the story. Multibaggers that happen in this category create HUGE wealth within short period of time. And most investors look for this category only.

Example:

Hawkins Cookers: A CAGR of 84% in the last 5 years. If someone invested 1Lac in 2009, now he will be sitting a cashpile of about 21 Lacs.

TTK Prestige: Returned a CAGR of close to 90% from 2009. Here 1Lac might have turned into 35 Lacs.

Eicher Motors: CAGR of around 87% in the last 5 years and still running fast.

The list also includes few other gems like Page Industries, Astral Polytec, Titan Industries, Crisil, Mayur Uniquoters, Cera sanitaryware, Kajaria ceramics, La Opala etc.

So, what made these stocks to give those spectacular returns in such a short span of time ?

What is the difference between Category 1 and Category 2 ?

Before answering that, lets understand this:

Their are 2 factors by which the stock prices move upward/downwards, PE and EPS.

EPS gives the earnings of the company per share. In most of the cases these earnings are real (this may not apply for Infra companies, Real estate company, Companies whose management is a crook and some times even for 20th or 25th company is a sector which is in bubble. Example: Penta media soft, DSQ software during 2000)

Now PE is nothing but the sentiment of the investors community (this includes everyone, Trader, Speculator, Bull Operator, Bear Operator, Algorithmic trader, and a dull and boring investor like me).

Technically, PE means “How many rupees you are willing to pay for a single rupee of earnings”. This gives the PE.

For example, Asian paints PE is 54 (or put it in another words, Asian paints is trading at 54 times earnings). This means the investors community is willing to pay 54 rupees for every single rupee that he is going to get from Asian paints on yearly basis.

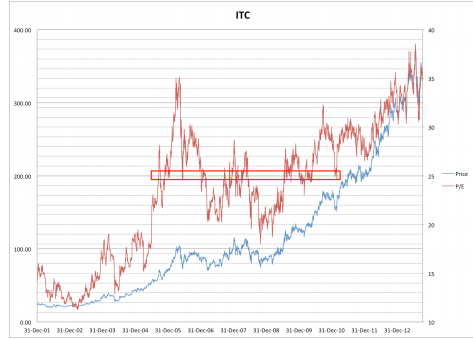

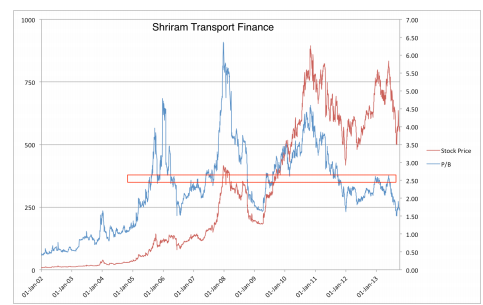

Below graph shows that how PE moved with respect to its Price for ITC and Shriram transport.

Images source: http://fundooprofessor.wordpress.com/

The unexpected interest of a company among the investors makes the PE to expand in short period of time. First of its kind company in a new sector enjoy this benefit.

1) Bharti Airtel: It was an emerging company in an emerging sector in 2003. Initially people didn’t understand the true potential of the company. Veterans like Raamdev Agrawal, Basant Maheswari had a vision to see the next 5 years of the company and made a killing out of it. During those days, Bharti Airtel used to trade at a single digit PE. In the next 5 years, PE expanded to around 80 times and made it a potential multibagger in just 5 years.

2) Page Industries traded at a PE of 22 in 2008 and it expanded upto 55 times in the span of 6 years and currently trading at around 55 times.

3) TTK Prestige PE expanded from 12 to 40 in 5 years.

Now what do we understand ?

Multibaggers of category 1 happen:

When their is longevity of Earnings. In other words, these companies continue to deliver for years together and their “Earnings” increase with very little movement in “PE” of those stocks. These companies usually take decade or two to multiply 50, 100 times with very less risk to the portfolio.

Asian Paints, HDFC bank, ITC, Nestle etc always traded at premium PE’s because of the trust on its Earnings. (Some exceptions are incidents like 2008 crisis where these companies are available at throw away PE’s)

Multibaggers of category 2 happens mainly because of PE Expansion:

It can happen some where or the other sector in every bull run:

IT in 1997-2000,

Infra in 2003-2007,

Consumer durables 2007-2013,

Semi-Urban and Rural housing (as expecting by many): Currently.

It can even happen on company basis (first time companies in that sector) on both bull and bear periods:

Airtel 2002-2007,

Pantaloons 2002-2008,

Eicher Motors 2009-Till date.

Krisha enough of Gyaan. Show me the NUMBERS !!!

Yes, even I too love numbers. Lets jump into it.

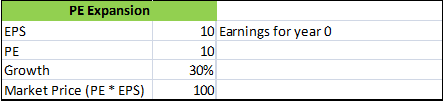

PE Expansion:

Initially, the stock remains unrecognized. Therefore the PE multiple is less then the growth rate. Usually here, even though the company is

growing, market does not believe the growth that the company is experiencing.

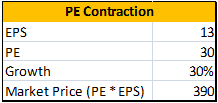

Let us assume that a company with a growth of 30% is given a multiple of 10 for an EPS of Rs 10. The market price is Rs 100.

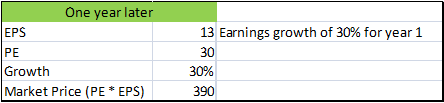

After one year, earnings rise to 13 (10 + 30%). Investors started believing in the company and its earnings. As the stock gains recognition and more coverage it starts getting a higher multiple of say 30 times.

This makes the market price of the company to go to 13*30 = Rs 390/-

See, even though there is no absolute increase in the company’s earnings. Just because the investors have recognized the true potential of its earnings, its price moved up 4 times in just one year.

This is just half of the story !!!

PE Expansion will make you RICH and at the same time PE Contraction will cut off the neck unknowingly.

PE Contraction:

The heights of Infosys stock price in 2000’s weren’t reached till 2006-2007. The peak of Bharti Airtel (574 in 2007) haven’t met till date and is currently trading at 392 (as of Nov 17th 2014).

Why & How ?

Lets take the same example:

Once the stock has been recognized and the market convinced about the growth rates the PE multiples move ahead of the growth rates. For instance during the 2000 technology boom Infosys was valued at more than 100 times its earnings since the company was delivering a growth of 100% year after year.

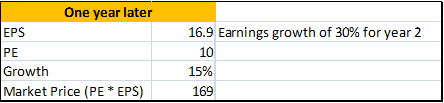

Let us assume that in the example given above the company’s growth rates tapers off to a more realistic 15%.

These changes in growth rates do not happen year on year but still the market responds to this change earlier

then they are out in the public domain because of this the PE multiple of the company will contract

See what made the price to move from 100 to 390 in one year and the same price to move back to 160 in next year.

Many times, the company in category 2 moves to category 1. If it doesn’t then it will be part of a next coming bubble, be prepared.

If you understand this, then next time you can classify why a company price is increasing and on what basis ?

So, tomorrow morning you go to office and check you portfolio as part of your daily routine and see the price movements. If it is NOT an earnings season, make sure you keep a close eye on PE expansion and PE contraction of your stock.

Finally, “PE expansion is like a pinch hitter in the cricket XI it makes a quick fire 40 in 25 balls but expecting it to make another 40 in the next 25 balls is difficult.”

END

Sources:

Theequitydesk.com

Motilal Oswal wealth creation reports